A Rapidly Growing Market,

An Underestimated Challenge

The global clear aligner and retainer market continues to expand at an unprecedented pace. Yet while orthodontic appliance adoption accelerates, the critical issue of proper maintenance remains significantly overlooked—creating a widening gap between product innovation and user care standards.

Retainer Hygiene: A Long-Overlooked Reality

The consequences of inadequate retainer cleaning extend far beyond user discomfort. Understanding the full scope of this challenge reveals why it demands serious attention from every stakeholder in the orthodontic care chain.

Daily Wearers Face Compounding Issues

- Casual cleaning with water or toothpaste leads to persistent bacterial buildup and biofilm formation

- Unpleasant odors develop gradually, affecting user confidence and compliance with treatment

- Material degradation from improper cleaning agents accelerates appliance replacement cycles

- Reduced wear time due to discomfort ultimately compromises treatment outcomes

Practices Struggle with Standardization

- No unified cleaning guidelines exist, leading to inconsistent patient education across practices

- Post-treatment complications are difficult to attribute—was it the appliance or the care routine?

- Patient complaints erode trust in the practice, not just the recommended products

- Staff time consumed by addressing preventable hygiene-related follow-up issues

Reputation Risks Accumulate Silently

- Complaint patterns emerge slowly, making root cause identification challenging

- Negative reviews citing odor or discoloration damage brand perception disproportionately

- Liability exposure increases when cleaning guidance is absent or inadequate

- Market positioning suffers when competitors offer superior care ecosystem support

The Core Issue: A Perception Gap

Across the entire value chain, retainer cleaning is treated as an afterthought rather than an integral part of orthodontic care. This perception disconnect between product sophistication and maintenance standards creates compounding problems that surface gradually—often only becoming visible when brand damage has already occurred. The industry needs a fundamental shift in how cleaning solutions are developed, positioned, and recommended.

Addressing these challenges requires partners who understand the full scope of retainer care—not just product suppliers, but solution collaborators.

Similar Packaging, Vastly Different Formulations

The retainer cleaning tablet market presents a paradox: products appear interchangeable on the shelf, yet their formulation philosophies, dissolution characteristics, and material interactions vary dramatically. Understanding these differences is essential for informed sourcing decisions.

Active Ingredient Architecture

The core cleaning mechanism determines both efficacy and safety. Not all oxygen-release systems perform equally, and the presence or absence of enzymatic components creates meaningful functional differences.

Dissolution Dynamics

How a tablet dissolves is as important as what it contains. Rapid dissolution may seem desirable, but controlled release often provides superior cleaning with less material exposure risk.

Material Interaction Profiles

Modern orthodontic appliances use diverse thermoplastic materials, each with distinct chemical sensitivities. A formulation safe for one material may cause cloudiness or brittleness in another.

Common Retainer Materials & Cleaning Considerations

Each material responds differently to cleaning chemistry

Understanding these technical distinctions helps identify suppliers who truly engineer for orthodontic applications—not merely relabel existing denture care products.

The True Cost of Suboptimal Product Selection

In B2B procurement, the consequences of choosing the wrong retainer cleaning tablet supplier extend far beyond immediate product quality. The risks compound across brand reputation, regulatory standing, and long-term partnership stability—often materializing when it's most difficult to course-correct.

Brand & Reputation Exposure

Consumer complaints about retainer discoloration, lingering odors, or material degradation don't distinguish between appliance makers and cleaning product suppliers. Your brand absorbs the negative perception regardless of root cause.

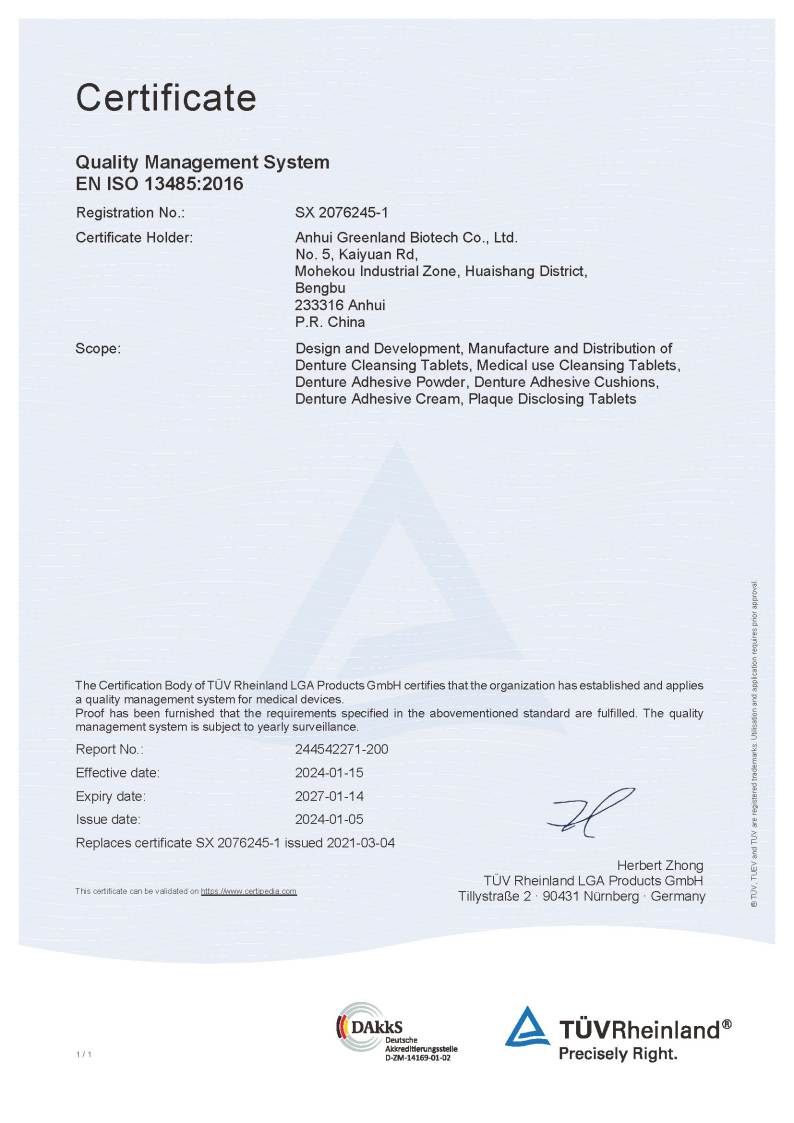

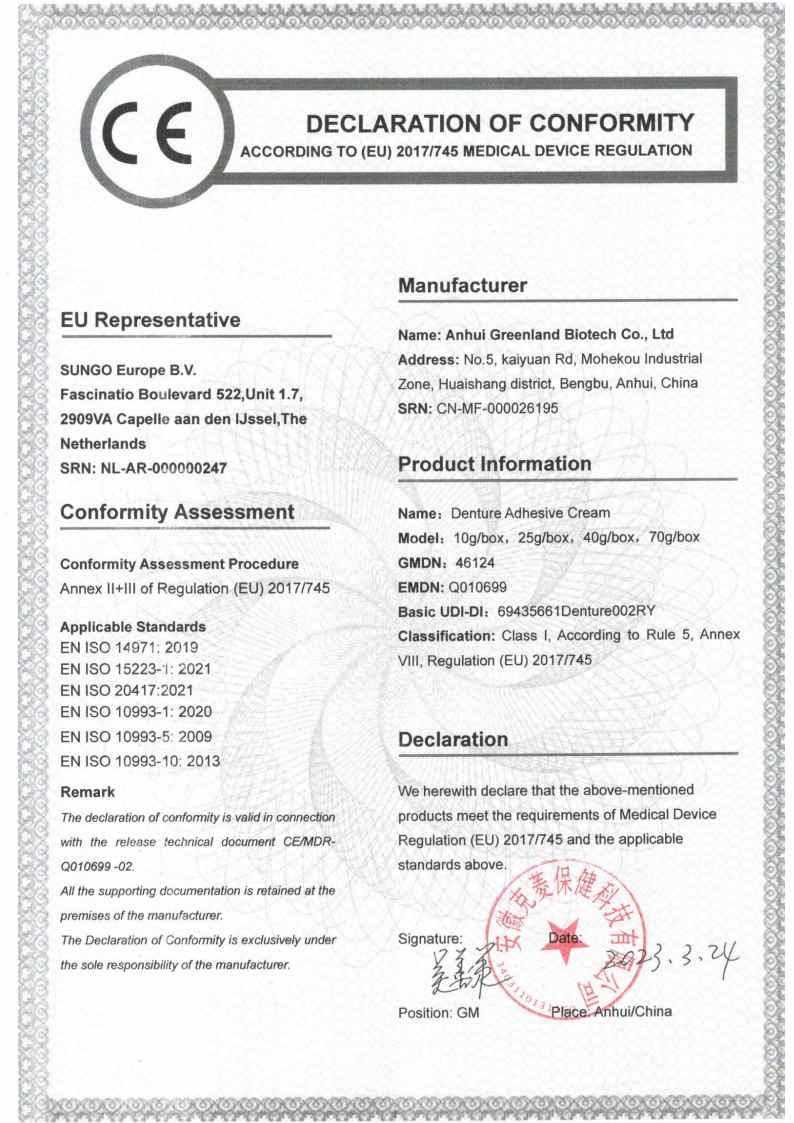

Regulatory & Compliance Vulnerability

Ingredient compliance, claim substantiation, and documentation requirements vary significantly across markets. Suppliers who cannot provide complete regulatory support create latent liability that may surface during audits or incidents.

Partnership & Operational Friction

Switching suppliers mid-stream carries significant hidden costs: reformulation testing, packaging redesign, regulatory re-registration, and relationship rebuilding. The true cost of a "cheaper" initial choice often materializes only after commitment.

Most sourcing problems don't announce themselves immediately. The product you're using now may simply not have failed yet—which is very different from being genuinely reliable.

How Problems Typically Unfold

Avoiding these risks requires partnering with suppliers who understand B2B accountability standards—not just manufacturing capabilities.

Different Scenarios, Different Product Requirements

Retainer cleaning needs vary significantly based on distribution channel, end-user demographics, and usage patterns. A product optimized for one context may underperform in another—making scenario-specific formulation a critical sourcing consideration.

Professional Recommendation Channel

When clinics recommend cleaning products, their professional reputation is attached to performance outcomes. Products must meet higher efficacy and safety thresholds.

Direct-to-Consumer Daily Use

Consumer brands need products that deliver consistent experience across diverse home environments while supporting brand differentiation and customer loyalty.

Adolescent Compliance Focus

Younger users often have lower cleaning compliance. Products must be simple enough to encourage consistent use while remaining effective despite variable habits.

6–24 Month Continuous Use

Retainers worn for extended periods accumulate stubborn deposits and face material fatigue. Cleaning products must be effective yet gentle enough for daily long-term use.

The Implication for B2B Buyers

A responsible product approach starts from understanding the end-use context, not simply minimizing unit cost. Generic "one-size-fits-all" formulations rarely deliver optimal results across diverse application scenarios—and may create hidden liability when performance expectations aren't met.

Identifying the right product configuration requires scenario-specific consultation—not just catalog selection.

Western Markets Are Raising the Bar

Regulatory frameworks and consumer expectations in North America and Europe are evolving rapidly. What passed as acceptable yesterday may not meet tomorrow's standards—making proactive compliance a competitive necessity rather than optional overhead.

Stricter Ingredient & Claim Compliance

Regulators in the EU and US are tightening requirements for cosmetic and quasi-drug products. Ingredient disclosure, claim substantiation, and safety documentation face increasing scrutiny.

Long-Term Oral Contact Safety

Products designed for repeated contact with oral appliances face heightened safety expectations. Consumers and regulators alike question cumulative exposure effects more than ever before.

Professional Endorsement Value

Brands increasingly seek products that can credibly claim professional backing. Generic commodity products struggle to command premium positioning or clinic partnerships.

Key Market Compliance Landscapes

Regional variations require market-specific preparation

Navigating these evolving requirements demands suppliers who understand destination market nuances—not just manufacturing capabilities.

The Industry Doesn't Lack Products—It Lacks Standards

The retainer cleaning tablet market is crowded with options, yet meaningful quality benchmarks remain elusive. Without established industry standards, buyers navigate by price and packaging—two metrics that reveal little about actual product performance or safety.

When there are no shared standards, the industry relies on experience and intuition—

and neither scales reliably across markets, partners, or time.

Safety for Long-Term Contact

Retainers are worn for hours daily, often for years. The cleaning solution residues that remain after rinsing become part of the user's oral environment. Safety isn't just about ingredients—it's about cumulative exposure.

"Is this formula tested for repeated oral contact?"

Efficacy That's Verifiable

Claims like "kills 99.9% of bacteria" mean little without standardized testing protocols. True efficacy standards would specify test conditions, target organisms, and measurement methods.

"Can this claim be independently verified?"

Batch-to-Batch Consistency

A sample that performs well in evaluation is meaningless if subsequent production batches vary in dissolution rate, active concentration, or pH. Stability standards ensure predictable performance over time.

"Will batch #1000 perform like batch #1?"

Documentation & Compliance

Regulatory requirements differ by market, but comprehensive documentation—SDS, COA, stability data, ingredient declarations—should be standard, not exceptional. Complete files enable confident market entry.

"Are all required documents available now?"

The Practical Implication

In the absence of industry-wide standards, buyers must establish their own evaluation criteria—and find suppliers capable of meeting them consistently. This shifts the burden of quality definition from the industry to individual procurement decisions.

Working with suppliers who already operate to high internal standards reduces the burden of establishing and enforcing quality baselines.

What Should an Ideal Retainer Cleaning Tablet Deliver?

Moving beyond generic product descriptions, a truly well-designed retainer cleaning tablet should satisfy a clear set of functional and experiential requirements—requirements that reflect real-world usage conditions and end-user expectations.

Material-Safe Across Retainer Types

Compatible with TPU, PETG, PMMA, and multi-layer composites without causing cloudiness, brittleness, or surface degradation—even with daily use over extended periods.

Controlled, Predictable Dissolution

Dissolves within a defined timeframe (typically 3-5 minutes) without leaving undissolved particles or requiring water temperature extremes that could damage appliances.

No Irritating Residue or Aftertaste

Rinses clean without leaving chemical taste, fragrance residue, or compounds that could irritate oral tissues during extended wear following cleaning.

Clear, Intuitive Usage Instructions

Simple enough for teen users and non-English speakers to follow correctly, reducing misuse that could compromise cleaning effectiveness or appliance longevity.

Professional Recommendation-Ready

Supported by documentation that allows orthodontic clinics to confidently recommend the product without liability concerns or patient experience risks.

Performance Benchmarks

Key metrics that matter

3-5 min optimal dissolution window

pH 6.5-7.5 neutral range for material safety

Zero residue after standard rinse protocol

24+ month shelf stability under standard conditions

"These benchmarks aren't arbitrary—they're derived from real-world usage patterns and material science constraints. Meeting all of them consistently separates serious manufacturers from commodity suppliers."

Products that meet these criteria don't just perform better—they reduce downstream problems across the entire value chain.

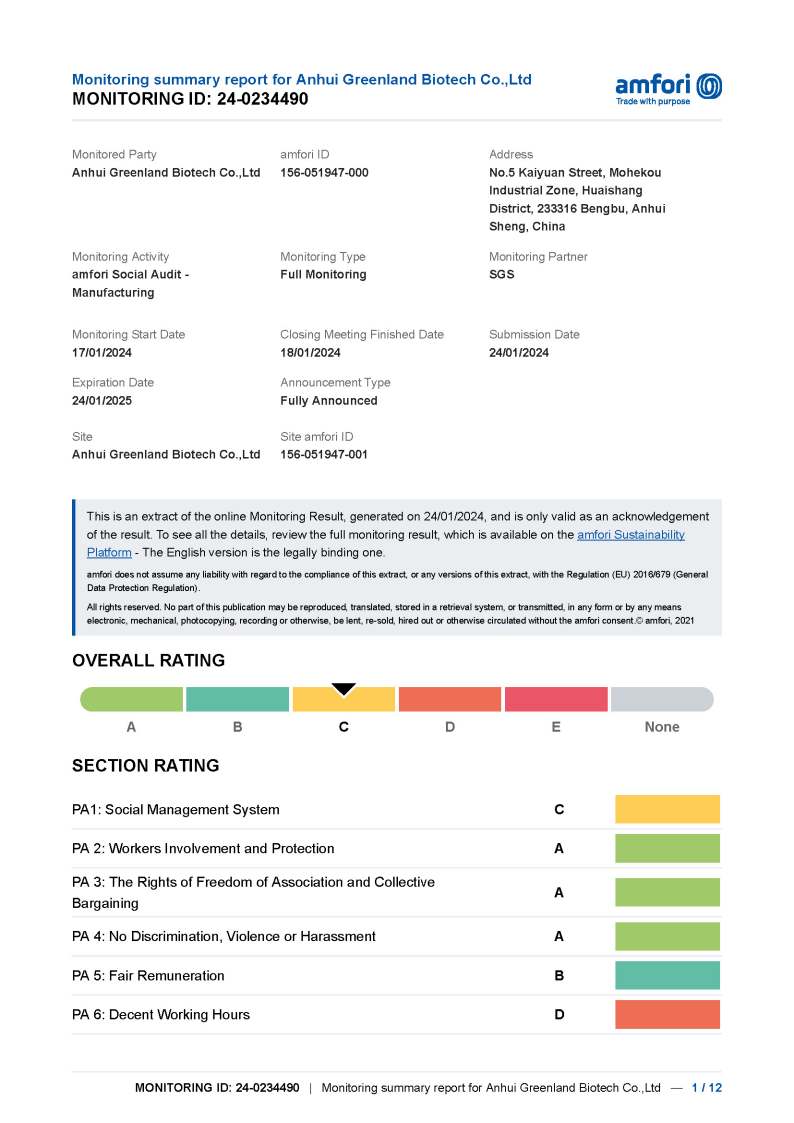

What B2B Buyers Actually Prioritize

Experienced procurement professionals understand that the lowest quoted price rarely translates to the lowest total cost of ownership. In the retainer cleaning category, supplier selection criteria extend far beyond unit economics—touching operational efficiency, risk management, and strategic positioning.

Batch-to-Batch Consistency

Nothing disrupts operations like quality variance. When every shipment performs identically, you eliminate the hidden costs of incoming inspection, customer complaints, and emergency supplier switches. Consistency isn't a feature—it's the foundation.

Complete Documentation, First Time

Chasing certificates, safety data sheets, and compliance documents wastes weeks of procurement cycles. Suppliers who provide complete, accurate documentation upfront demonstrate operational maturity—and respect your time.

Destination Market Fluency

A supplier who understands EU cosmetics regulations, FDA classification nuances, and regional labeling requirements prevents costly compliance failures before they happen. This knowledge gap separates transactional vendors from strategic partners.

Reliable Long-Term Supply

Product launches require confidence that supply won't disappear mid-season. Suppliers with proven production capacity, inventory management systems, and contingency planning earn trust that transcends individual orders.

Stability beats cheap.

Every time.

The real cost of supplier instability—quality variance, documentation delays, compliance gaps, and supply disruptions—far exceeds any unit price savings. Smart buyers optimize for total cost of partnership, not just invoice amounts.

Finding suppliers who deliver on these priorities requires evaluation beyond price sheets—it requires dialogue.

Why Manufacturing Background Matters in This Category

Retainer cleaning tablets may appear simple, but consistent quality at scale demands sophisticated manufacturing capabilities. The difference between a formulation that works in the lab and one that performs reliably across thousands of production batches is substantial—and often invisible until problems emerge.

Trading Companies & Small Workshops

Limited manufacturing control

Established Manufacturing Facilities

End-to-end production capability

Formulation Is Iterative

Effective formulations aren't created once—they're refined continuously based on production feedback, stability testing, and market input. Only manufacturers with direct production involvement can iterate effectively.

Scale Demands Systems

Producing consistent quality across 10,000 vs. 1,000,000 units requires fundamentally different capabilities—automated mixing, environmental controls, in-line testing, and statistical process management.

Accountability Requires Control

When quality issues arise, manufacturers with vertical integration can identify root causes and implement corrections. Intermediaries without production control can only relay complaints—not solve problems.

True manufacturing capability isn't claimed—it's demonstrated through facility tours, production records, and consistent delivery history.

Common OEM/Private Label Pitfalls to Avoid

Custom manufacturing in the retainer cleaning category carries unique risks that aren't always apparent during initial supplier evaluation. Understanding these common mistakes helps buyers structure partnerships that avoid costly mid-stream corrections.

Packaging Change Without Formula Review

Assuming that changing packaging on an existing formula is sufficient for brand differentiation. The underlying product may not be optimized for your target market or user demographic.

Performance gaps surface after market launch, requiring costly reformulation or brand repositioning.

Ignoring Target Market Regulations

Using formulations developed for one market without verifying compliance in the destination market. EU, US, UK, and Australian requirements differ significantly in ingredient restrictions and labeling.

Products held at customs, forced recalls, or inability to make intended marketing claims.

Skipping Application Testing

Proceeding to production without testing the formula against actual retainer materials and real-world usage conditions. Lab performance doesn't guarantee field performance.

User complaints about material damage, discoloration, or inadequate cleaning emerge post-launch.

Copying Instructions Without Adaptation

Using generic usage instructions that don't account for specific product characteristics, target user literacy levels, or language localization requirements.

Misuse leads to product failures blamed on formulation rather than instruction clarity.

The Better Approach: Structured OEM Partnership

Successful private label programs in the retainer cleaning category begin with comprehensive needs assessment—not price negotiation. Understanding your target market, user demographics, distribution channel, and compliance requirements enables suppliers to recommend appropriate formulations and identify potential issues before production commitment.

Avoiding these pitfalls requires suppliers who ask the right questions upfront—not just those who quote quickly.

A Mature Supplier Delivers More Than Product

In B2B relationships, the difference between a vendor and a partner lies in what happens beyond the purchase order. Suppliers who invest in supporting customer success—not just fulfilling orders—create value that compounds over the partnership lifecycle.

Formulation & Dosage Guidance

Technical consultation on formula selection, active concentration optimization, and dosage form recommendations based on your specific market positioning and user requirements.

Application Scenario Analysis

Expert assessment of your target use cases—clinic recommendation, DTC retail, teen users, extended wear—with product configuration recommendations for each scenario.

Regulatory File Preparation

Comprehensive documentation packages tailored to destination market requirements—from EU CPNP submissions to FDA cosmetic compliance and beyond.

Market Differentiation Advice

Strategic input on product positioning, competitive differentiation opportunities, and emerging market trends that can inform your go-to-market approach.

The suppliers who invest in understanding your business—not just filling your orders—

become partners whose value extends far beyond unit pricing.

True partnership begins with understanding your objectives, not just your specifications.

In This Category, We Choose a Specific Role

ITS Dental Care Products approaches the retainer cleaning tablet market with a clear understanding of what we are—and what we are not. This clarity enables us to serve partners who share our priorities effectively, while being transparent with those who may find better fits elsewhere.

We are not the lowest-price supplier—and we don't try to be. Our focus is on delivering consistent quality and complete support that justifies partnership investment.

We prioritize long-term compliance and supply stability over short-term transaction volume. Partners who value predictability over opportunism find us well-aligned.

We focus exclusively on B2B relationships—we don't sell directly to consumers or operate retail channels that could compete with our partners' businesses.

Our goal isn't to be the supplier for everyone—it's to be the right supplier for partners who share our commitment to quality, compliance, and long-term thinking.

Tailored Support for Different Partner Types

We recognize that clinics, brands, and distributors have distinct needs and priorities. Our support approach adapts to each partner category, ensuring relevant value delivery at every stage of collaboration.

Orthodontic Clinics & Dental Practices

Supporting healthcare professionals who recommend cleaning products as part of patient care protocols, where professional credibility is paramount.

Consumer Brands & Private Label

Enabling brands to bring differentiated retainer care products to market with confidence in formulation quality and regulatory compliance.

Distributors & Regional Importers

Supporting channel partners who build regional markets for oral care products, requiring reliable supply and comprehensive market entry support.

From Product Search to

Long-Term Solution Partnership

The best partnerships begin with understanding—not quotations. Share your market requirements, and let's explore whether our capabilities align with your objectives.

Direct Contact

Prefer to reach out directly? Here's how to connect with our export team: